How Factoring Solves the Cash Flow Problems of Printing Material Companies

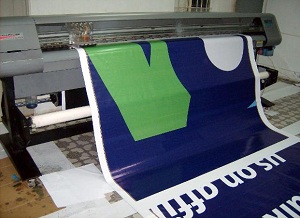

Managing a printing material company is a tough job these days, especially with businesses shifting into a paperless environment. Aside from this challenge, printing firms have also been hounded by a familiar woe�cash flow problems. Printers have to wait for months before their clients pay up, resulting to serious shortage of money. When this happens, managers of printing firms have to find ways of raising capital to pay for labor and other operational expenses.

Managing a printing material company is a tough job these days, especially with businesses shifting into a paperless environment. Aside from this challenge, printing firms have also been hounded by a familiar woe�cash flow problems. Printers have to wait for months before their clients pay up, resulting to serious shortage of money. When this happens, managers of printing firms have to find ways of raising capital to pay for labor and other operational expenses.

Printing firms can�t approach banks and apply for a loan since bank loan processing can take months to get processed and approved. Bank loans will also require these small firms to offer something valuable like real estate and vehicle for collateral, something most printing companies won�t be able to comply with.

Fortunately for these small businesses, factoring lenders offer a better solution to their cash flow problems. Factoring, or invoice financing, is a scheme that addresses the funding needs of printers. Factoring facilities are granted quickly to printers that can present their invoices, especially if these are collectibles from topnotch companies. There are many reasons why printing firms should avail of factoring financing for their cash flow requirements.

Quick Processing and Approval

Small printers don�t have the luxury of waiting for months to get access to funding. Billing statements from their own suppliers as well as salaries of personnel have to be settled within weeks. Thus owners or managers of printing firms won�t even think of applying for a bank loan that will take months to get approved and for the money to be released.

Instead, owners of printing material companies apply for business invoice factoring that takes only a day or two to get approved. The application process is simple and quick. Proprietors of printers only have to fill out a form and send it along with their invoices to a factoring lender. In some cases, the application may be approved an hour or two after the submission of these requirements. The printer proprietor then gets money equal to as much as 90% of the amount indicated in the invoices which he or she could use to pay for the firm�s various obligations.

No Debt

Under a factoring arrangement, printers won�t incur any debt unlike in a bank loan. The factoring lender will collect the money from the printer firm�s clients then remit the remaining amount to the printing firm less a small fee. The arrangement also frees up the printer personnel from collecting payments from their clients, allowing them to focus on more important business needs.

Printing companies may be facing cash flow challenges on a weekly basis, but this does not mean they won�t be able to grow their businesses amidst a tough economic environment. Through the help of factoring lenders like NeeBo Capital, printing material companies can have adequate money to pay for their operational expenses without incurring debt. NeeBo Capital offers one of the best rates in the business invoice factoring industry, and can expedite the factoring application procedure. Contact us now for your factoring financing needs!

Why Choose Us?

Rates at 0.59% - 1.5% for 30 days

Quick Link to Financial Resources:

| Purchase Order Financing | Accounts Receivable Financing | Asset Based Lending Options |

General Articles about Accounts Receivable Financing and Factoring:

» 08/01/2012 Debt Financing or Off Balance Sheet Financing?

» 11/30/2012 Utilizing Factoring as a Alternative to Traditional bank Credit

» 07/22/2012 Increase Your Business Lines Of Credit By Factoring Accounts Receivables

» 09/15/2011 What to know when selecting a Factoring Company